━━━━━━━━━━━━━━━Made in Europe by Europeans━━━━━━━━━━━━━━━

Part of this project was financed through Invitalia's Smart and Start to support the birth and growth of innovative start-ups with unique code CUP C41B21002050008-SSI0003195

Some tech components of this project are funded by the European Union through PNRR and co-approved by the Italian Minister of Culture with Identification number PNRRBI-20230003279910/2

Cookie Policy

| Privacy Policy

| TOS Terms of Service and Conditions

| EULA End-User Level Agreement

SLA Service Level Agreement

| Security and transparency

| Code of conduct

| System requirements

(CC) 2026 - Some rights reserved | Attribution-ShareAlike 4.0 International License | Public Beta v.1.2

ECOMATE S.R.L. - c/o Fintech District - Banca Sella S32 - Via Filippo Sassetti 32, 20124 - Milano, Italy

VAT Number: IT-10841230963 | REA: MI-2560957 | Registered Capital: € 16.189,10 fully paid-up | CEM: ecomate@pec.it | SDI: M5UXCR1

ACCREDIA

Ente Unico Nazionale

EA (European Accreditation)

The proprietary "Ecomate ESG Rating" scheme has been accredited by Accredia with agreement dated 11/04/2025 and protocol PG01205284SOI according to the ISO/IEC 17029:2020 - UNI ISO/TS 17033 - UNI/PdR 102:2021 standards and is valid for certification purposes by CABs (Certified Accredited Bodies).

In compliance with the provisions of art. 52 of Law no. 234/2012 and subsequent Legislative Decree no. 34/2019 (Growth Decree), the State aid and de minimis aid received by our company are reported in transparency, subject to the obligation of publication in the National Register of State Aid (RNA)on the next page.

Ecomate S.R.L. is identified in the European Transparency Register under the number 1719568139885-09 with its acceptance of the code of conduct as a company operating in advisory committees and working groups.

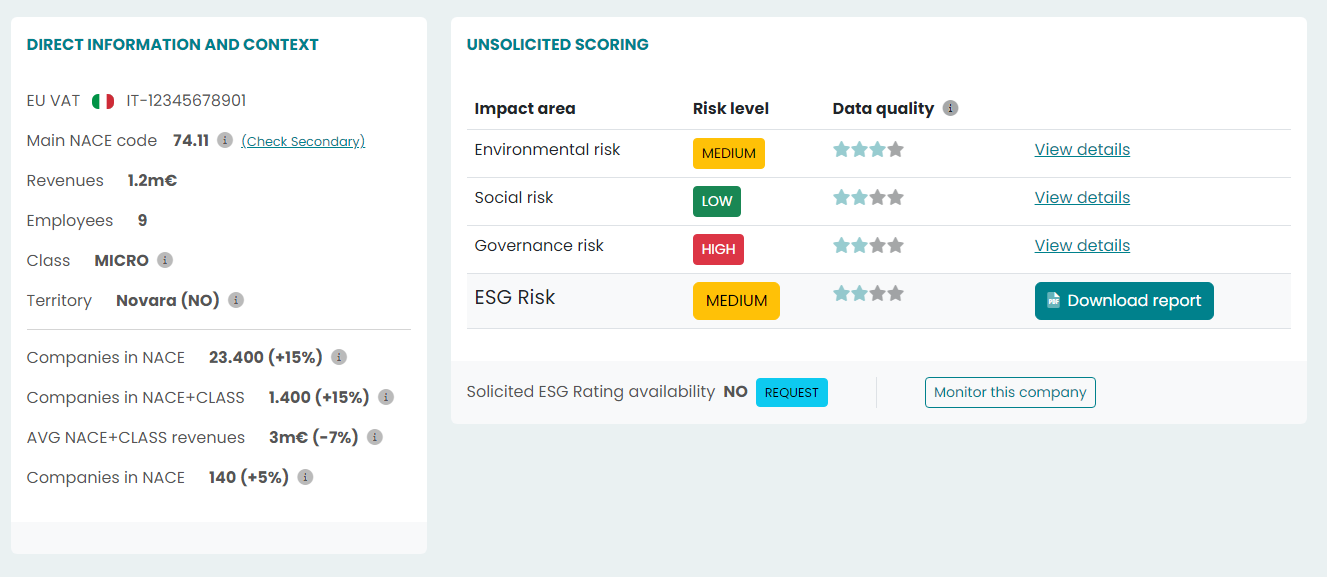

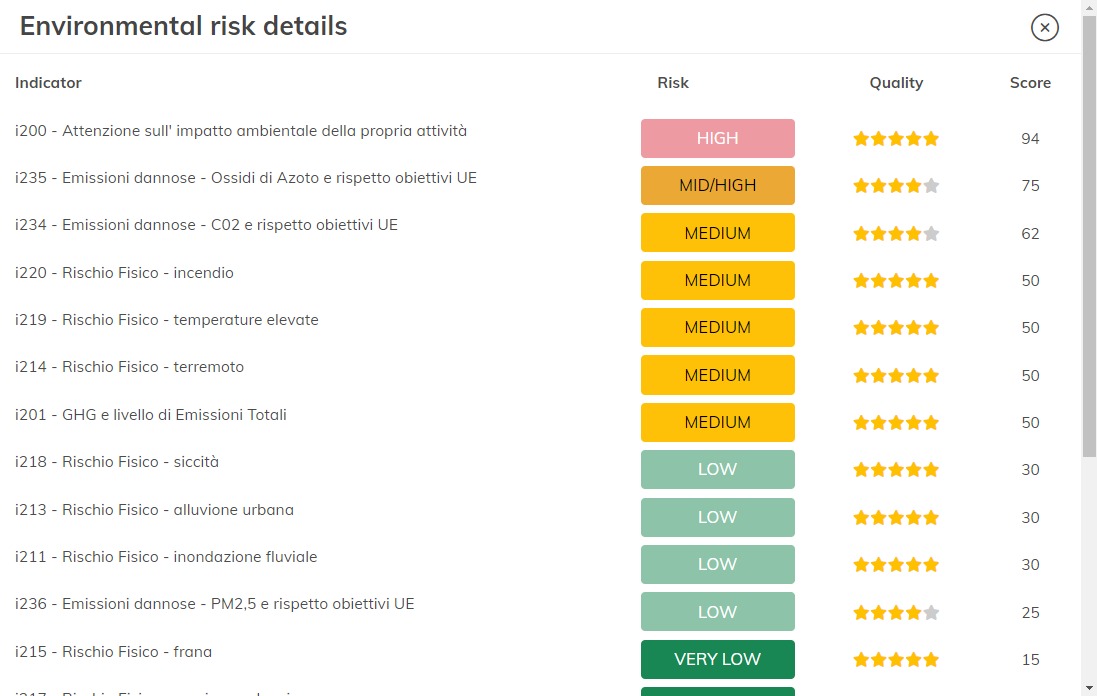

DISCLAIMER: Solicited and unsolicited ratings issued by Ecomate S.R.L are: (a) based on the counterparty company data available in the National Business Register at the time of issuance; (b) based on an open standard supported by a decentralized, crowdsourced technical-scientific committee acting in an advisory capacity; (c) processed by our deterministic algorithmic systems and rule-based fraud detection mechanisms against the counterparty’s input; (d) reviewed by an analyst; (e) not a financial forecasting model and should be only considered as an opinion on the degree of alignment of the counterparty with European Union sustainability guidelines and regulations, standards and objectives included in the environmental, social and governance dimensions, as well as EU Strategy and Policy 2030-2050, namely that the counterparty company may not be able to meet its compliance requirements, reporting obligations or even being under ESG litigation or “ESG default”, as an evaluative risk condition.

ISSUANCE: Only solicited ESG Ratings that have successfully undergone a formal and substantial verification led by our ESG analysts, are deemed verified, issued and then authorised for public use. Ecomate S.R.L. strictly prohibits the publication or dissemination of unverified solicited ESG Ratings in any external communications, including but not limited to websites, social media platforms, stakeholder reports, or other public channels. Any unverified ESG rating published externally constitutes a serious breach of Ecomate S.R.L.’s internal policies and governance rules, is expressly prohibited, and may result in significant legal and reputational consequences.

REGULATORY NOTICE: Ecomate S.R.L. is committed to applying for ESMA (European Securities and Market Authority) supervision under the EU ESG rating providers framework from Q3-2026. During the transitional period, Ecomate S.R.L. applies an internal governance and control framework aligned with the principles and requirements of Regulation (EU) 2024/3005, in anticipation of ESMA supervision.

MIFID2/MIFIR notice: Ecomate S.R.L. does not provide any financial or ESG consultancy activity nor other potentially conflicting activities and its ESG information does not amount to financial, legal or other professional advice, nor does it constitute: (a) an offer to purchase shares in the enterprises referred to; or (b) a recommendation relating to the sale and purchase of related products/services; or (c) a direct recommendation to take any particular legal, compliance and/or risk management decision.